The works involve the construction of two 29-storey residential towers on a four- storey podium with a one-level basement. The two towers will be home to 493 units, the GFA will be around 24,400 square metres, on a site area of 2,711 square metres.

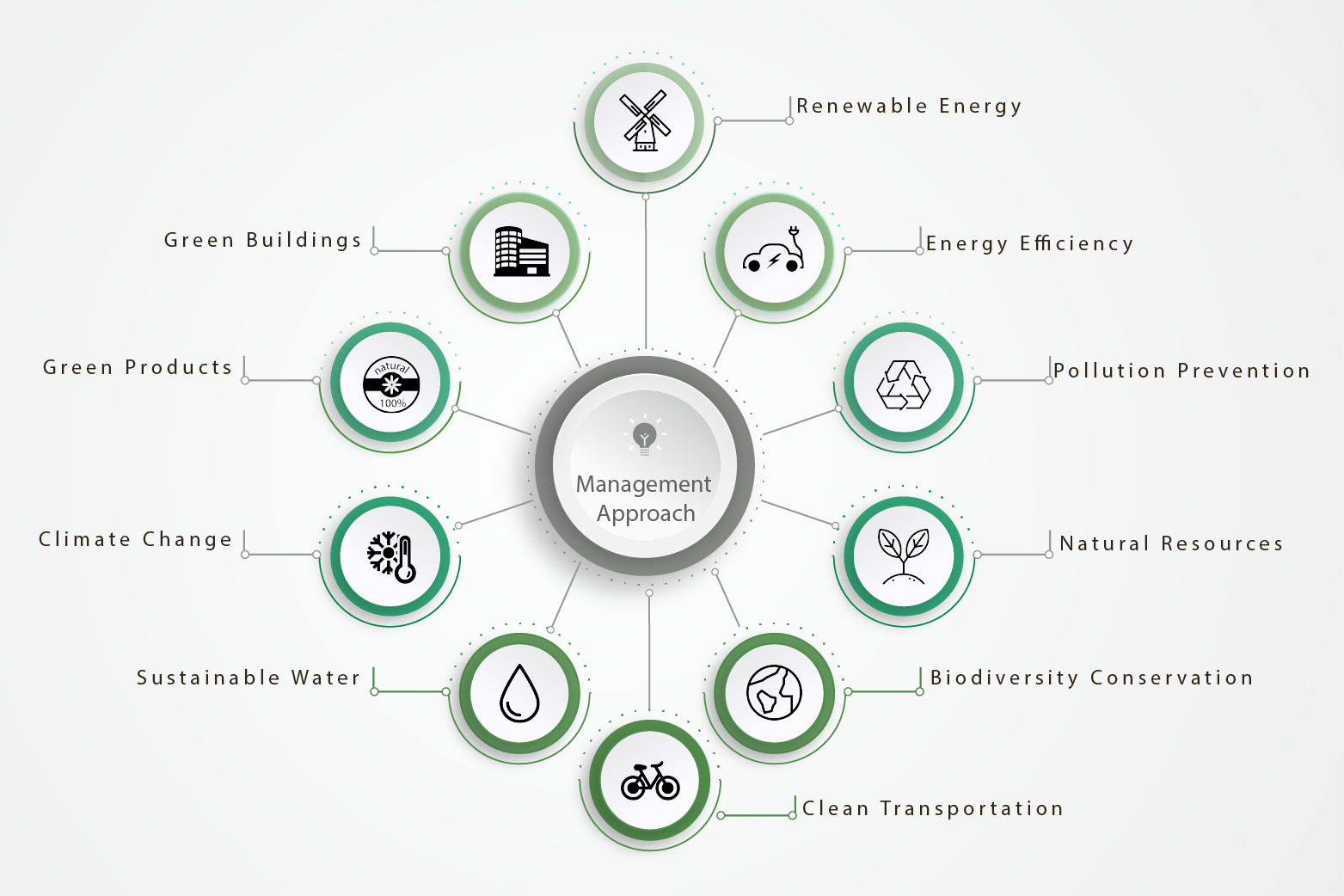

The latest lean construction innovation Building Information Modelling (BIM) adopted to enhance the project’s environmental friendliness and construction efficiency. The project aims to meet the most stringent Building Environmental Assessment Method Platinum standard.

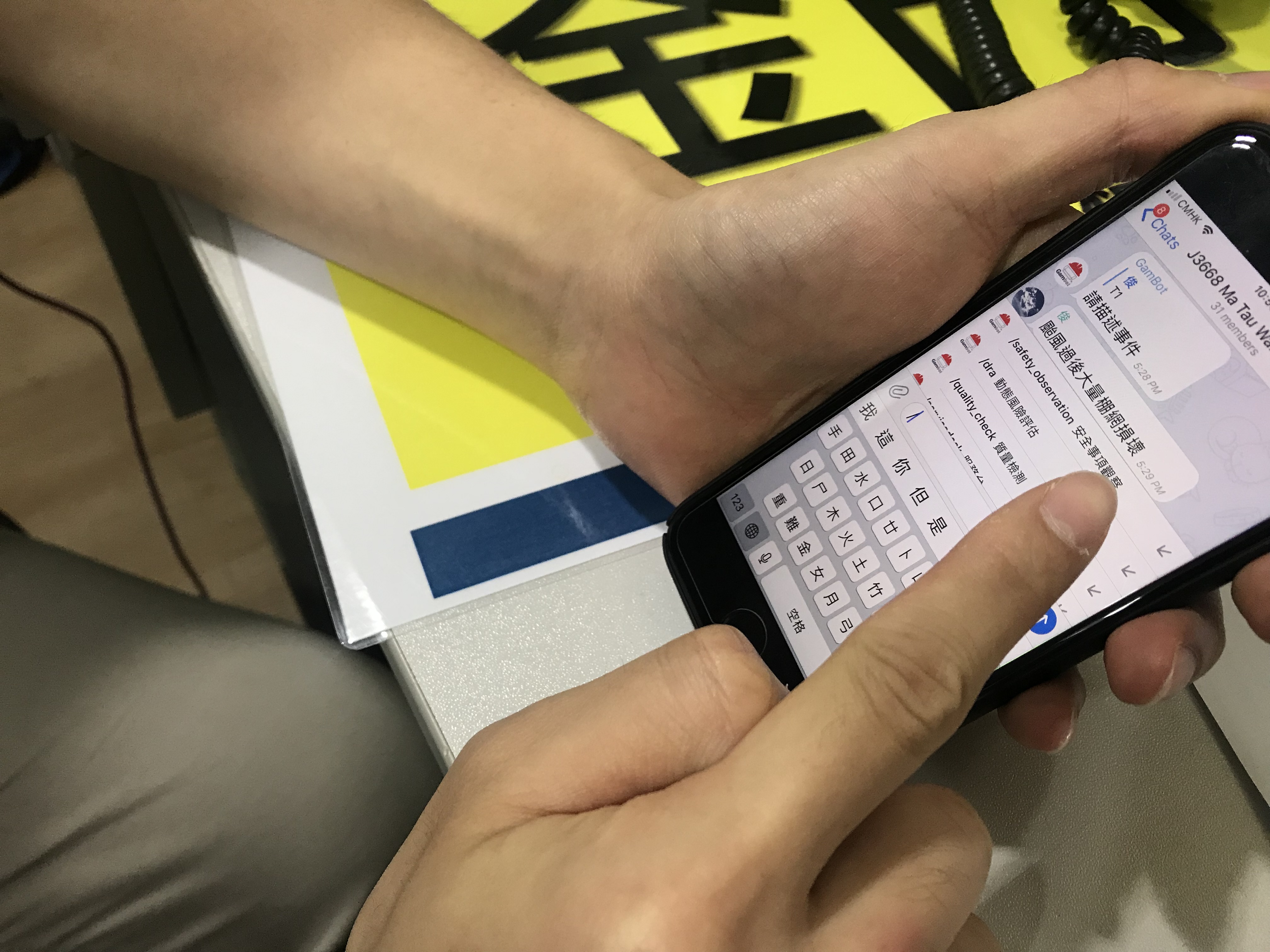

Colleagues report any problem such as observation that may cause potential danger to the workers, as well as environmental and quality issue. The project can inform all frontline staffs via the apps which they can receive up-to-date information. The project proposes mitigation measures to lessen the risk and provide better working environment to the workers.

Since then, safety awareness is raised among workers which lead to healthier, safer, and more productive environment.

Any discrepancy between the installation detail and design model will be informed on-site and also in coordination meeting which ensures the work quality and helps to meet the tight construction program.

Supply chain is one of issues during the meeting to prevent any materials accumulation which helps to lessen the burden of the congested site area.

All staff can get the first-hand information and assess the potential dangers of work in morning assembly every day. Everyone can raise opinion and concern during assembly.

Besides, warm up exercise will be carried out to get ready for the later work.