Construction of Public Rental Housing Development at Wing Tai Road, Chai Wan, the works of a 37-storey domestic block (including ground floor), 826 flats and works outside the boundary of the site including covered walkway, emergency and service access, play areas, ball courts, pavilion etc.

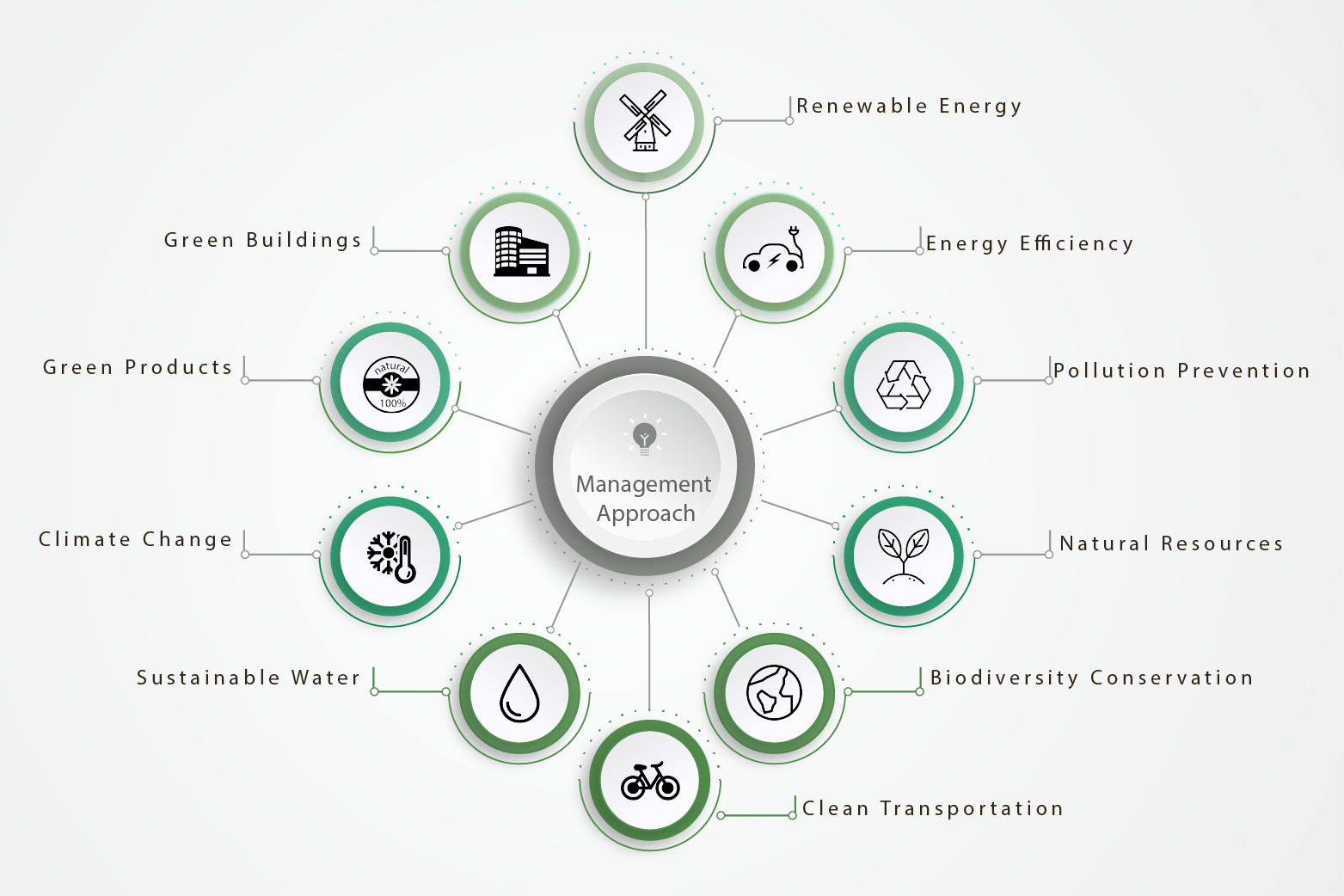

Shui On committed to utilize the energy and natural resources in the site operational and personal levels systematically to achieve concepts of sustainable construction development.

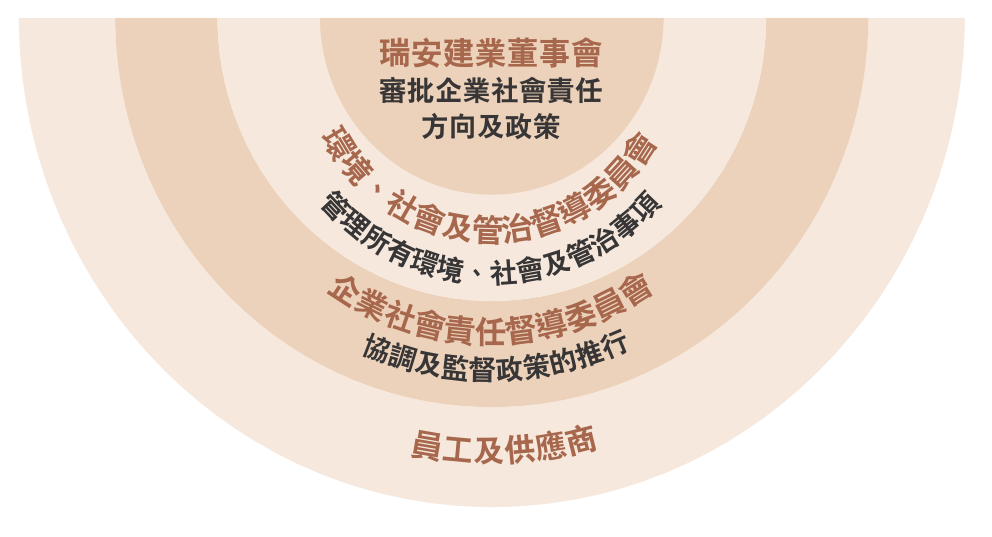

In 2008, a Corporate Social Responsibility Policy Statement was established to set goals, promote team and cross-departmental cooperation. The Board of Directors have appointed the Committees of Environment, Society & Management and the Corporate Social Responsibility to be responsible for day-to-day management: Integrate corporate social responsibility and sustainable development concepts into daily operations and activities by various departments of the Group.

Use of discarded safety helmets to grow potted plants inside them. The safety helmets were either collected from other sites after completion of work or expired helmets collected from our site.

Considering the large water utilization of site operation, hydroelectric generators were installed at water supply system. The electricity generated by hydropower was used for the light signal of refuse chute. It is high applicability and easy-to install, approximate 5kg CO2e of carbon emission to be reduced annually