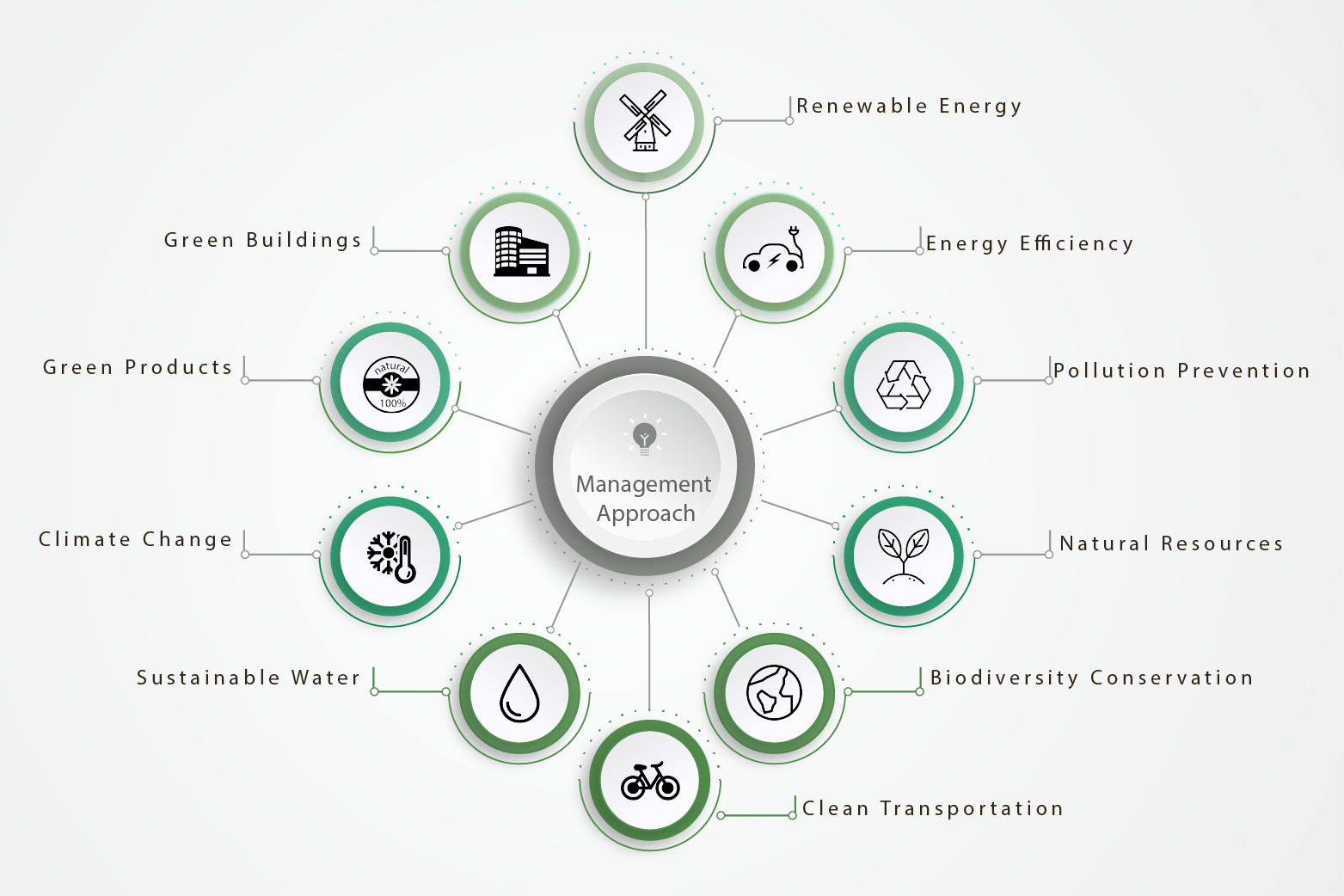

The project included the design, construction, completion and maintenance of the rehabilitation of existing Quarry in Lam Tei, NT. The landform is formed by blasting to produce rugged and natural-looking rock faces. Rock generated from blasting shall be served as raw material to produce aggregate products for concrete and asphalt production. They are taking steps to sustainable construction including: 1) reduce water consumption by re-use/recycling of wastewater and surface runoff; 2) introduce environmental friendly blasting, “KAPRA”, a new blasting technology which could minimize dust and noise nuisance and 3) reduce carbon footprint by minimizing transportation of material transfers.

Wastewater and surface runoff shall be collected and diverted to de-sludge plant for dust suppression and street cleaning.

Supply Chain Management: Blasting, crushing, stockpiling, transportation and production of concrete and asphalt were performed inside the site to reduce fuel consumption during transportation.

The KAPRA EPI pulse Plasma Rock Fragmentation is approved by Mines Division, CEDD. This new blasting technology induces much lower vibration, air overpressure, low noise and less dust & fly rock compared to conventional blasting.