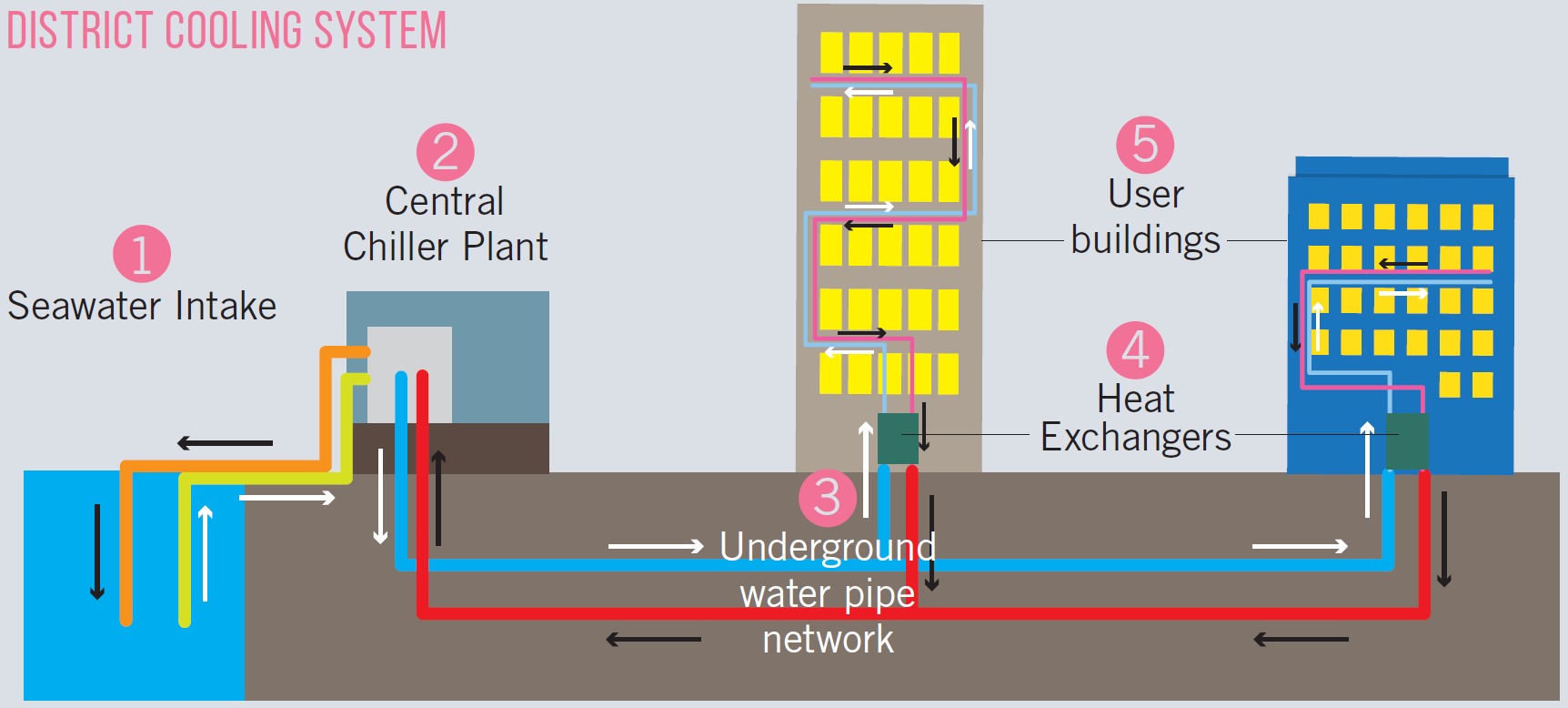

The Distict Cooling System (DCS) at Kai Tak Development (KTD) is a large scale centralized air-conditioning system which produces chilled water at the central plants and distributes the chilled water to consumer buildings in the KTD through underground water piping network. With its high energy efficiency, the implementation of DCS at KTD will achieve estimated annual saving of 85 million kilowatt-hour (kWh) in electricity consumption, corresponding to a reduction of 59,500 tonnes of carbon dioxide emissions per annum and maintain sustainable development.

Based on her previous involvements in DCS construction, chiller installation and T&C stage, as well as coordination with EMSD maintenance team, Ms. Law has modified the requirements in the particular specification based on the operational need, such as power arrangement, equipment materials, selection, protection installation method and control setting etc., to enhance and optimize the operation performance and maintain continuous improvement in sustainability and energy saving.

Targeted to achieve better performance than international standards and Building Energy Code, Ms. Law keeps review the particular specification and explore the opportunities of improving the sustainable requirements on higher chiller COP, variable speed drive chiller, environmental friendly refrigerant, BIM-AM for DCS plants, disposal of Construction and Demolition materials. All of the above measures can maintain a sustainable development.

Mr. Law serves the engineering industry with endless passion and aim at build a better Hong Kong. She is nominated as the YEA Committee Chair this year and keep organising events with other engineering societies to share the latest technologies and ideas to our members. She take this opportunity to promote DCS and other sustainable and energy efficiency measures to public in various occasions. The above photo shows the first Open Day at the North Plant of Kai Tak DCS organised on 19 May 2018.