The contract mainly involves widening of Fanling Highway of about 2.1 Kilometres from a dual threelane to dual four-lane carriageway from Tai Hang to Wo Hop Shek Interchange. The main construction works include construction of bridges, retaining walls, noise barriers, drainage and underground utilities. The widening works are proposed in order to mitigate the traffic congestion on Fanling Highway and copy with the anticipated increase in traffic flow in the future.

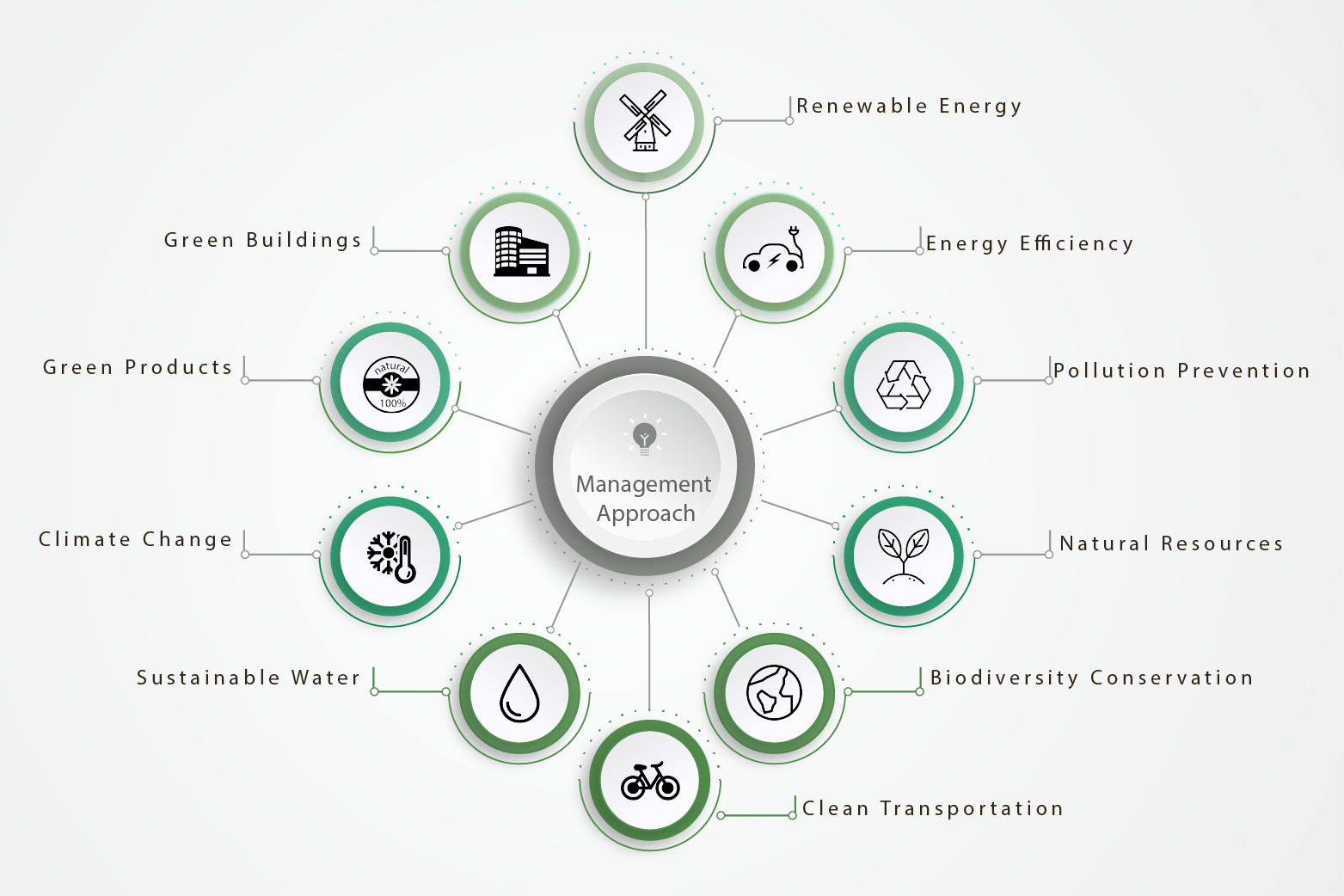

They propose alternative designs by pavement overlay in lieu of full reconstruction and reduce scope of piling works for noise barriers construction. Consumption of nature resources is reduced and disposal of construction wastes is avoided by adopting the alternative designs. The project also promotes the use of renewal energy and greening the construction site.

A comprehensive investigation has been carried out to demonstrate that the existing pavement with the properties and conditions are complying with the design requirements and rehabilitation of pavement by resurfacing is feasible. The proposal can directly avoid generation of about 175,580m³ C&D material.

They propose alternative design by reducing scope of piling for noise barriers construction. It reduces the numbers of piles and length of stem wall and increases the quantity of backfilling. Adopting the alternative design, consumption of concrete and steel bars are reduced by 2,396m³ and 969 tons respectively. Moreover, disposal of 14,669m³ surplus excavated is reduced by increasing backfilling.

Installation of grid connected PV system at site office to promote the use of renewable energy and reduce energy consumption. They estimate that 12,488kW electricity is generated annually and it is equivalent to 8,486kg CO2 emission reduction.