The refurbishment project is to replace the entire Central to Mid-Levels Escalator and Walkway System that spans nine streets from Des Voeux Road to Conduit Road. To minimise inconvenience brought to the public, the project has to be conducted by phases. With proven skills and experience, and innovative solutions, Anlev Elex adds value to the system by improving its reliability, sustainability and providing greater convenience for users.

Refurbishing the system brings myraid challenges. As the project contract requires the canopies be untouched, We have to cut each escalator into six pieces, insert them from two ends of the covered space and reconnecting the pieces during installation. This complicates the installation process and requires additional logistical arrangements.

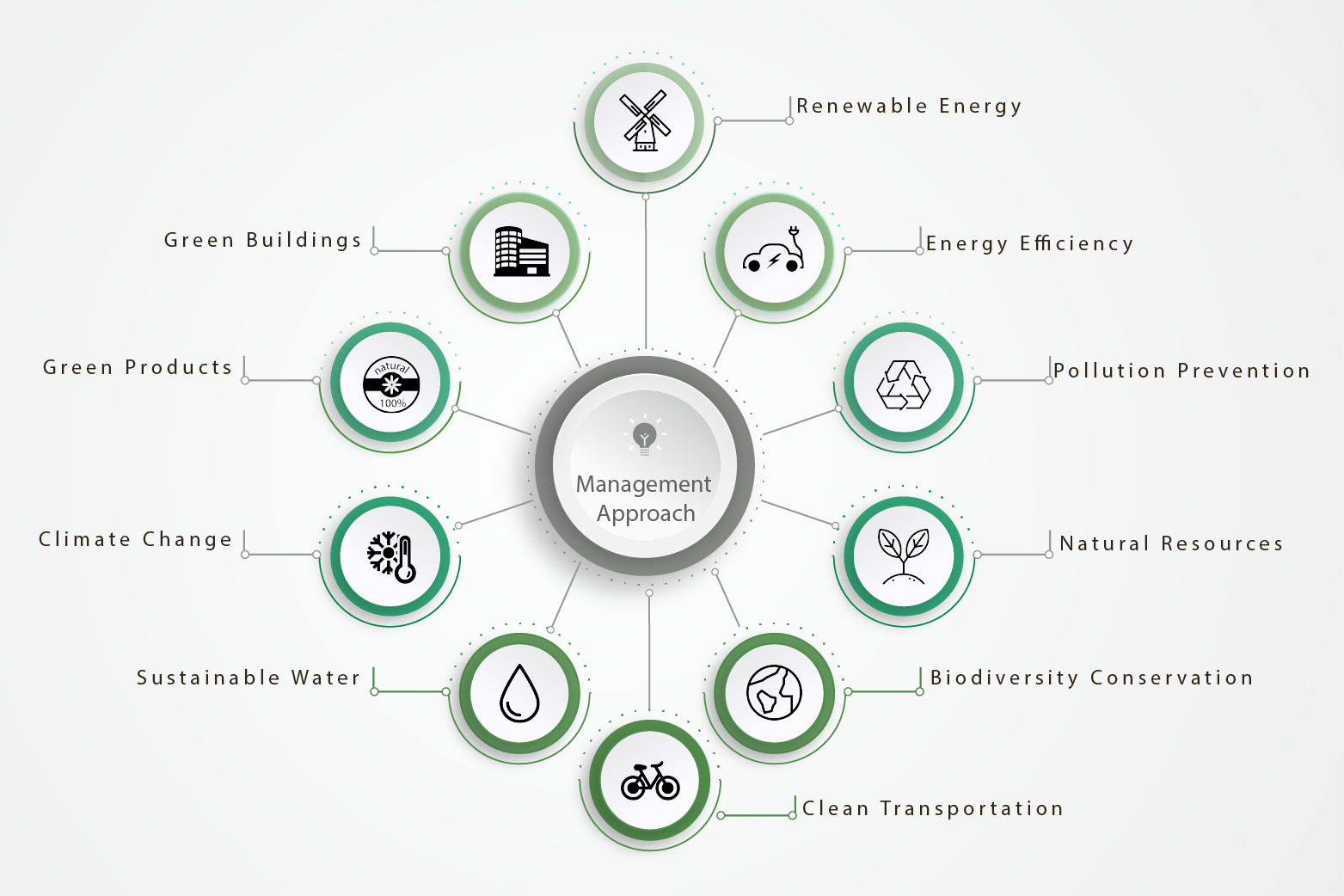

Part of the new system have been installed with colourful LED lights along the escalator skirt panels for better illumination as well as energy efficiency features such as energy saving motors, variable speed drives and service-on-demand functions.

Deploying truck cranes for lifting purposes on the neighbourbood’s narrow streets without unduly disrupting traffic is another challenge in this project. We are only allowed to have two hoisting sessions per day so as to minimise traffic disruption. Meticulous advanced planning is a must to avoid programme slippage.