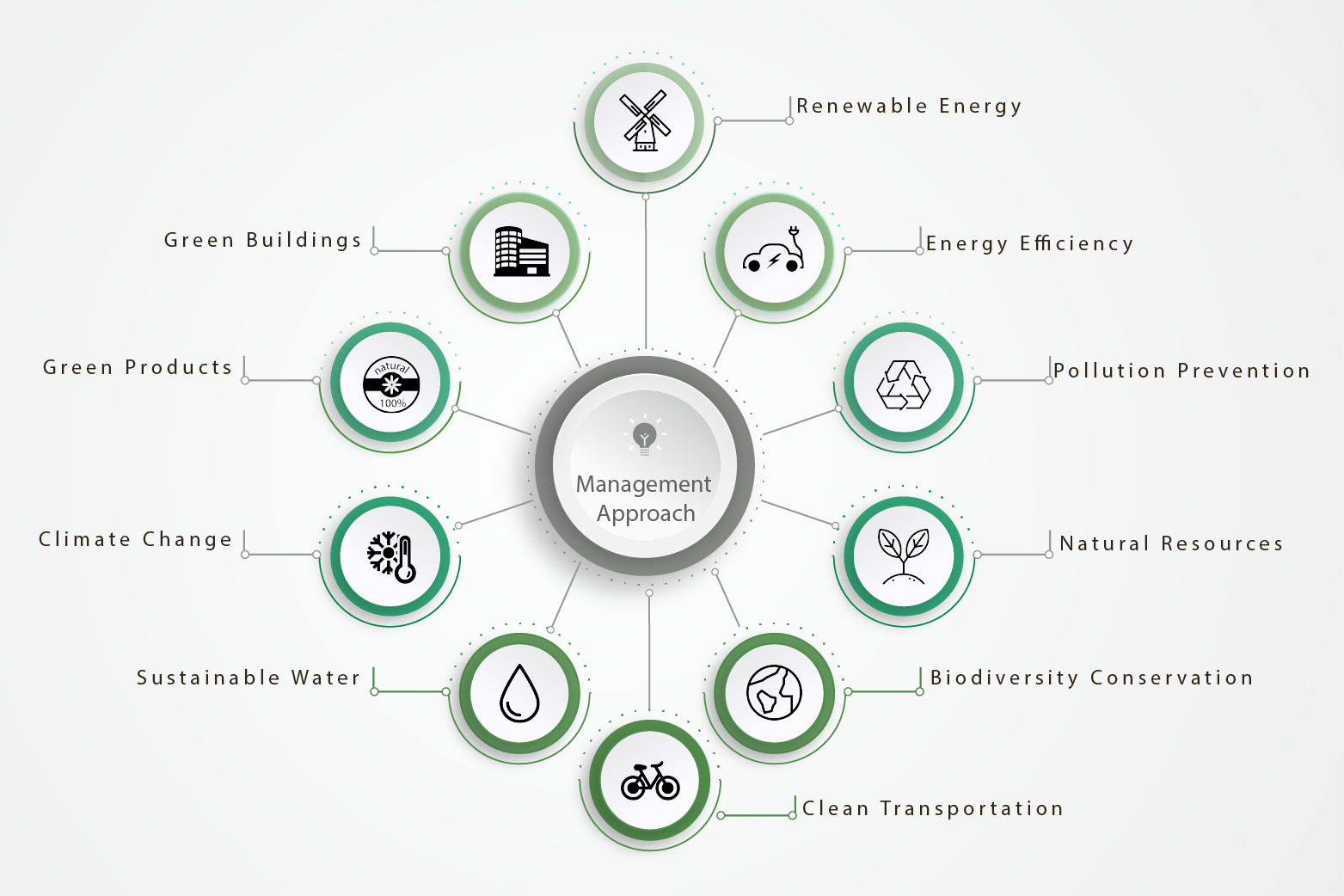

Tai Po Water Treatment Works is now undergoing an expansion to double its output capacity to 800,000 m³ per day upon completion. Being keenly aware of the responsibility towards sustainable construction, the plant is designed to merge into the surrounding landscape harmoniously by adopting the award-winning stacked design of different treatment processes to minimize the plant footprint with various green features. The plant also adopts photovoltaic panels to utilize renewable energy and water recycling systems to conserve precious water resources.

The project adopts numerous innovative and creative initiatives including reuse of waterworks sludge and stacked process design to preserve the natural habitat. Various greening, energy efficient, water saving and sustainable features have been developed for both the new and existing buildings to make the facility the first water treatment works achieving the BEAM Plus Provisional Platinum accreditation in 2017.

It has adopted Building Information Modelling (BIM) technology to facilitate its design of the on-site chlorine generation plant. BIM helped the project team visualize in advance the spatial arrangement of the equipment in relation to the surrounding environment. This resulted in higher efficiency in formulating an engineering solution. The successful adoption of the technology has won the Autodesk HK BIM Awards 2017.

It is located in a remote area surrounded by hilly terrain with limited space. The plant is compact with stacking of multi-treatment processes in multi-level buildings to minimize the facility footprint, thereby conserving the surrounding natural habitat. With such design, this environmentally friendly facility has won the 2006 Project Innovation Award from the International Water Association.