The King’s Road Commercial Re-development project comprises a 28-storey high-rise block. The project has received the first ever Green Loan in Hong Kong. The project adopts full BIM to promptly identify and resolve design conflicts at early design stage, thus avoiding the subsequent abortive works and environmental nuisances. Other sustainable measures include internal laboratories, innovative plants, comprehensive recycling and neighbourhood caring programme, etc.

The Project has successfully raised the first ever Green Loan in Hong Kong. It aligns with the Green Finance Policy of Hong Kong and China Governments, and achieves the Economic Pillar of Sustainability.

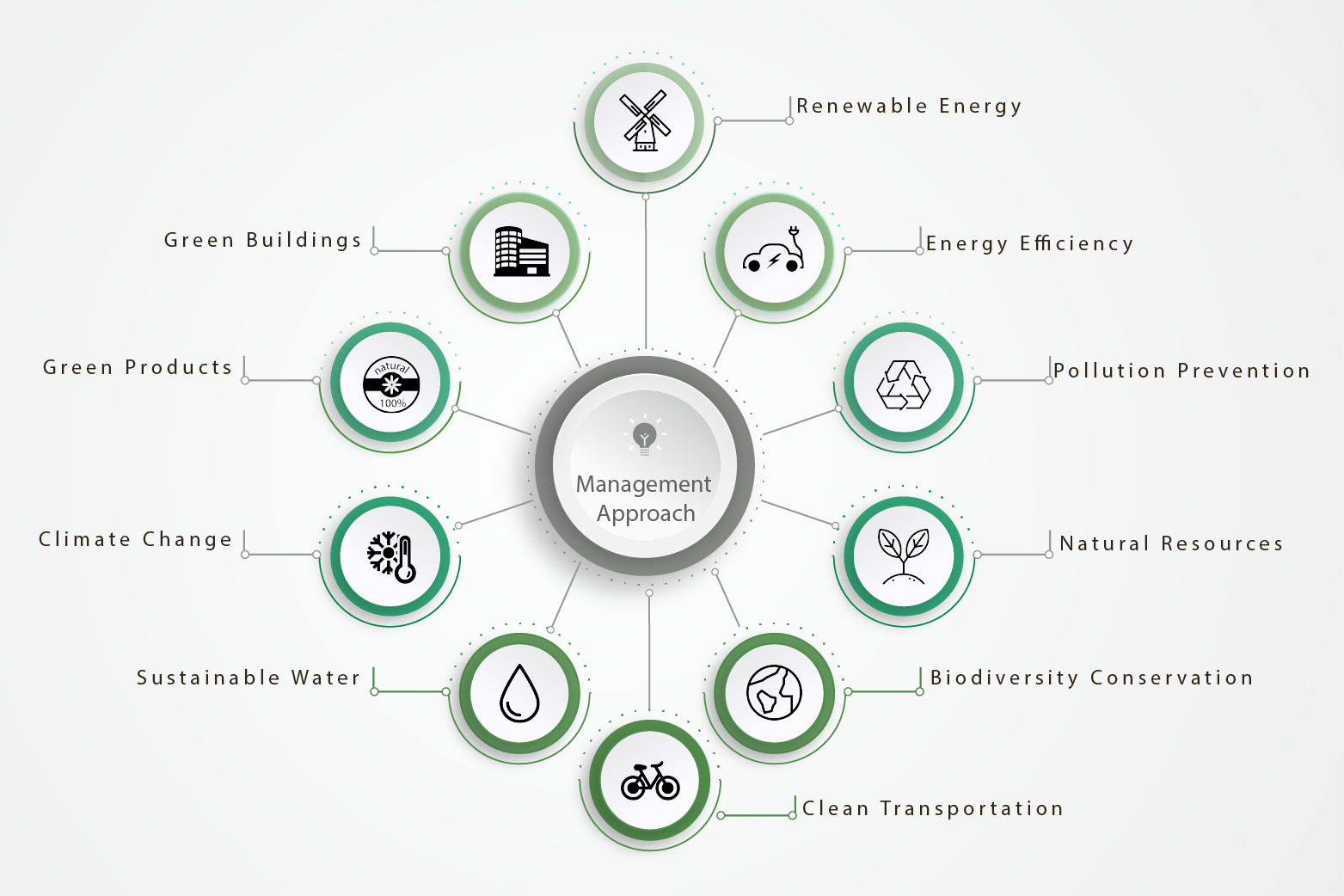

The project aims for the highest Green Building Certification levels, achieving the world’s first WELL Building Standard Core and Shell Precertification (Platinum), BEAM Plus New Building (Provisional Platinum) and LEED Building Design and Construction Core and Shell Pre-certification (Platinum).

- The “NCCOTM Air-Purification System” has been installed on Site to filter the air pollutants.

- The “Light Weight and Heavy Duty LED Lighting Tubes” are tailor-made for the construction environment. It is extremely durable and energy saving.

- The “Differential-Pressure Pumping System” sensitively detects the differential water pressure, automatically adjusts its operation, significantly reduces operation time and therefore tremendously saves energy.

The Project BIM Team are fully manned so that they can promptly respond to the frequent design changes, sort out quickly those hidden design conflicts and effectively avoid numerous abortive works and waste of materials.

New World Construction employs E-platforms to reduce paper consumption and boosts efficiency; examples include Construction Information Anywhere (CIA), Safety Information Apps, Self Service Portal (SSP), E-Newsletter, etc.