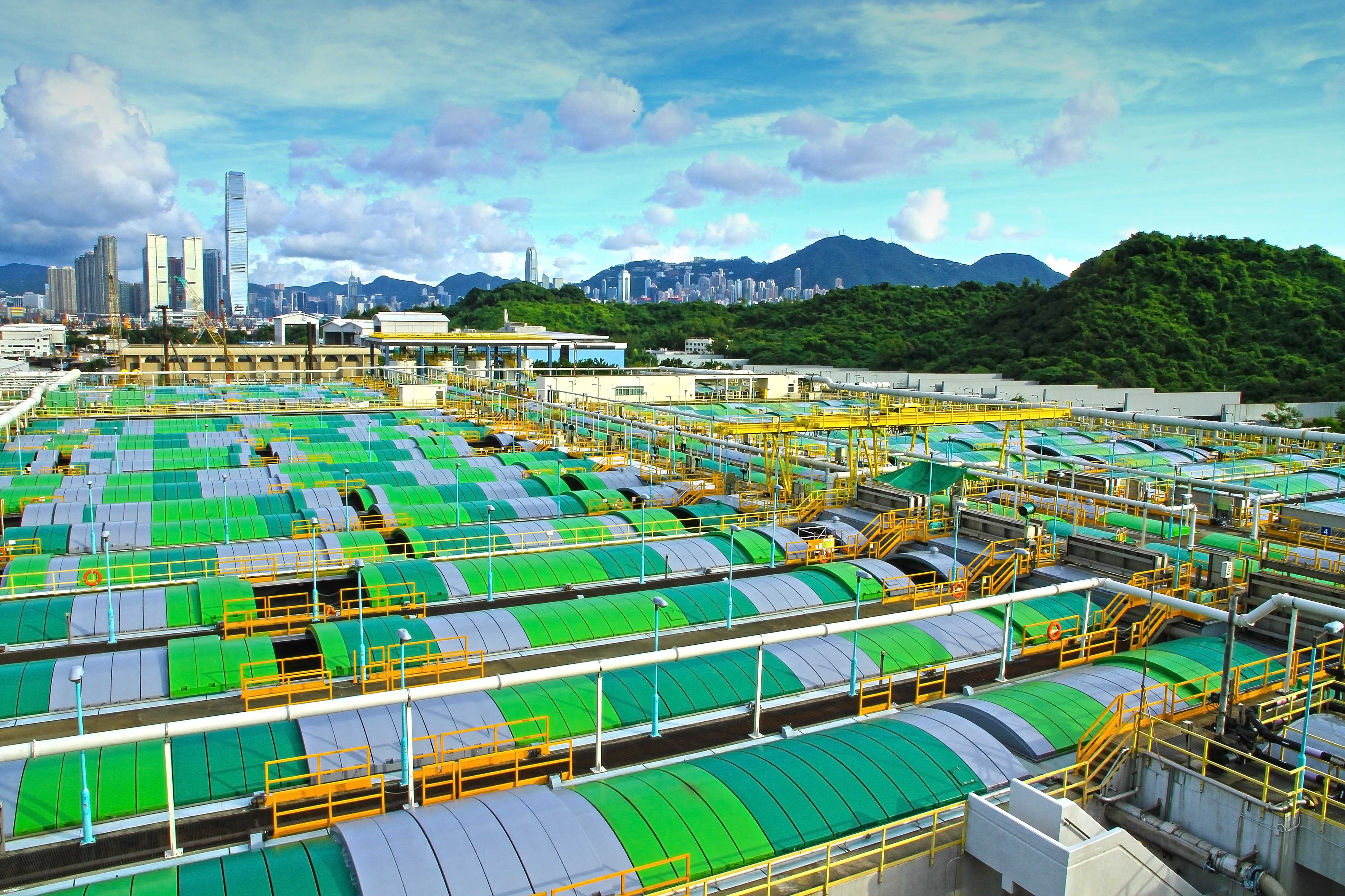

The Harbour Area Treatment Scheme (HATS) is a deep-tunnel sewage conveyance and treatment scheme serving the urban areas around Victoria Harbour, with a design population of 5.7 million. It comprises two stages: 1 and 2A, consisting respectively of 23 and 21 km of sewage tunnels, at depths from 70 to 163 metres below mean sea level. The highly land-and energy-efficient Stonecutters Island Sewage Treatment Works provides chemically enhanced primary treatment and disinfection, and has a design capacity of 2.45 million m³ per day. Commissioning of the HATS has significantly raised the water quality of Victoria Harbour and revived the marine environment.

The Stonecutters Island Sewage Treatment Works – a chemically enhanced primary treatment plant serving the highest population in the world. Its treatment capacity is 2.45 million cubic metres per day, equivalent to the volume of about 1,000 standard swimming pools together. Commissioning of the Harbour Area Treatment Scheme has served to revive the water quality and the vitality of Victoria Harbour.

A deep shaft of the Sewage Conveyance System, which comprises a 21 km of tunnels located at depth of 70m to 163m below mean sea level. Sewage enters the tunnels via deep shafts at the various Preliminary Treatment Works for conveyance to the Stonecutters Island Sewage Treatment Works. These are the world’s deepest sewage tunnels.

Sedimentation tanks of the Stonecutters Island Sewage Treatment Works - The tanks adopt a space-saving, double-tray design which reduces land uptake significantly. With a footprint of only 10.6 ha, (about half of the size of Victoria Park), the highly efficient design allows the plant to serve a population of 5.7 million.